How Much Can You Put In A 403b Per Year

Do you lot have a 403b? Isn't it frustrating how in the personal finance world e'er talks well-nigh a 401k merely not your 403b? Don't worry – I'm hither to help make certain yous're on rails with a 403b calculator!

Outset off, what fifty-fifty is a 403b?

A 403b is very, very like to the 401k only it is for people that work for the government or nonprofit organizations, such every bit teachers, professors, police, firemen, etc. Most of us won't qualify for a 403b as we're not selfless enough to do this blazon of work, but we practice have a 401k to fall dorsum on.

What actually is the departure between a 401k and a 403b?

Honestly, non much.

- Both have a 2020 contribution limit of $19,500 for an individual and $57,000 for a full contribution

- Both crave you to proceed your coin in the account until you're 59.v and if you don't, you're subject to a 10% fee

- Both will likely have a matching contribution

- Both will likely have a Roth option, significant your contributions are post-revenue enhancement, and so a pre-tax option

- Both likely have fairly high advisory fees, so information technology's very important to keep this in mind, only remember that fees are absolutely not a reason to invest, especially if you're getting any sort of matching.

I recently wrote a blog post about some of the biggest mistakes that you lot could make when you're investing in a 401k and since it's and then familiar with a 403b, I recommend y'all check it out, especially #three and #1, which talk about understanding your investment options and and then non matching out your match.

You see, any sort of friction match that you get is completely gratuitous money. Like, no strings attached, cold hard greenbacks. I say no strings attached, but you lot do have to wait until you're 59.5 years old, but that really isn't much of a string…I'd say that information technology'south much more of a dominion that is just protecting yous from yourself and inevitably elimination your retirement savings and using it for non-retirement things.

But of course, y'all likely know what a 403b is if you lot're reading this article because you likely have one – but how do you actually know if you have plenty coin to retire? Well? I think it'southward a few different steps:

ane – Determine Your Retirement Number

This likely seems like an impossible matter to do but trust me, information technology really isn't that hard! Permit me introduce you to the four% rule.

In essence, the 4% rule says that if you are to invest your money into a stocks and bonds portfolio, and you remove 4% of your starting portfolio for the first year, and then that aforementioned amount every yr, and so you should never run out of money.

Let me explain with an example:

- You retire with $1 one thousand thousand

- You will withdrawal 4% the starting time year, which is $forty,000, and then you will withdrawal that same amount every year after that

- You should theoretically never run out of money

I know that this might seem difficult to believe, but it really isn't when you put the pen to pad. Believe it or non, the results will actually daze you lot. I went back and looked at many time periods since 1928 when I used a portfolio that was a 60/xl ratio of stocks and bonds, the portfolio literally never ran out of money.

Insane, right?

While this is great, how tin can you really utilise it to your portfolio? Well, if you lot're going to accept out iv% every twelvemonth, and so you need to brand certain that you have enough saved to cover that, correct?

Let'due south pretend that you think you lot're going to need $50,000/year to maintain your quality of life. To be able to have out $50,000 each twelvemonth, y'all're going to only take $fifty,000/4%, or y'all can multiply $50,000 by 25, to become $ane,250,000.

So, if you salve $one,250,000, then you can safely withdrawal $50,000 every year, as the data shows, and never run out of money! Pretty dang cool to accept a very, very physical goal like that, isn't it? Simply that's only office of it!

2 – Determine if You're on Track with a 403b Retirement Reckoner

This is the really fun one if you ask me! As you all know, I am a huge numbers nerd and absolutely love earthworks into the data. I am guessing that you're the same, and even if you don't like getting in really deep, I created a very easy 403b calculator that you can utilise in a few easy steps to make sure you're on track:

All you need to use the calculator are a few unlike pieces of information:

- Your Starting Salary

- Almanac Raise Assumption – this is only the corporeality that you recollect your bacon volition raise. Maybe it'south mutual to go a three% raise, or ten%, or no raise at all. Patently, the lower number that you input, the more bourgeois the amount will exist.

- Personal 403b Contribution % – this is merely the amount that you plan to contribute.

- Visitor 403b Contribution % – this is just the lucifer that you receive. Plan the match around the amount that y'all plan to contribute. For instance, if the match is 1:1 up to 5%, but yous but programme to put in three%, then you lot demand to put in iii% for the company friction match. But if I tin can get one thing through to you in this article…delight, delight please – lucifer out the company friction match. And then, if it's upward to 5%, do 5%…at a MINIMUM! It'south literally complimentary money!

- Almanac Growth Assumption – the S&P 500 average since 1950 is 11%, so I similar to use 8% as a bourgeois guess. If you call up the market will be fifty-fifty worse than that, go lower! Try 6%! Again, the lower number that y'all put in here, the more than conservative, which is simply going to help you in the long run!

Let'south run through a real-life example:

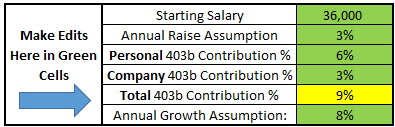

- Your Starting Salary – I am going to put in $36,000 as that is the average starting salary in Ohio, where I life

- Almanac Raise Supposition – I am going to presume three%, which is slightly over the average inflation rate of two%.

- Personal 403b Contribution % – I'one thousand going to say 6% here, because I am assuming that I will go a company friction match of 50% upwardly to 3%, meaning I take to put in 6% to become the total lucifer

- Company 403b Contribution % – as I just described, I am assuming a match of 50% on the 6% that I'm putting in, so a total of iii%

- Annual Growth Assumption – I am going to assume 3% here since, equally I noted to a higher place, I recollect this is a conservative assumption

Take a look below at the inputs and how they will look in the calculator:

Believe information technology or not, that's the finish of what you need to do to employ the calculator! You can then await at when you might retire and simple scroll down to that year and await at what your estimated total might exist! For instance, below shows but how the starting time v years might await:

Click to zoom As you tin can see, the beauty of investing is that in Year 1, you're really simply getting the 8% return on your initial investment and the company match. Merely the longer you invest, the more that you get to start earning that same 8% on not simply your investments but the returns that you accept already made!

That, my friends, is the dazzler of compound interest, and it's why Einstein said, "Compound involvement is the eighth wonder of the world. He who understands it, earns it … he who doesn't … pays it."

What he ways in this maxim is that if you actually understand compound interest, and so you're going to be very motivated to take reward as much equally you tin can and if you don't, and then you're really going to be paying for information technology in the long run.

If you lot already accept a 403b and aren't starting from scratch, but input all of the same numbers but modify the first cell to the amount that you currently have. For instance, if you have $x,000, yous would input $10,000 into cell C11, or Year 1, Month i, equally I have shown below:

Below, I have included some more results, in 5-year increments, based off the inputs that we discussed to a higher place in the original case where we are starting from scratch:

You'll likely narrow into the yellow highlight, which yous might find is just slightly over the $1.25 million goal that we likewise talked almost previously. So, that means if all of these assumptions were true, then you would accept to work 4 months into your 40th year to be able to retire and hit your retirement goal!

Whether or non that's actually what happens is going to exist up to y'all and the market performance, simply if y'all don't have this in mind when you lot're planning your retirement, so yous're starting off behind the eight brawl!

Now that you know where your program is going to put you, and when you're able to retire, the part that you can truly impact is beginning – allow'due south head to step three!

3 – Evaluate Your Plan

Let's stick with this same case that we've laid out above – if you lot're starting teaching after graduating college, say at age 22, this means you're going to retire effectually historic period 62. That might be correct on for you, or 3 year early if you've planning on historic period 65, or maybe information technology's even, oh I don't know, let'southward say vii years too late if you lot were hoping to retire at age 55.

What do you do?

Easy – regardless of which state of affairs yous find yourself in, increase your contributions! If you can, that is. If y'all're ahead of schedule or on schedule, y'all obviously don't need to do this, simply why not do it if you can?

The effect with Burn, or Financial Independence, Retire Early, is that it implies that you're working so hard to retire early. I like to say merely FI, or even financial autonomy, and then do whatever I want. So maybe the acronym is FADWIW (Fiscal Autonomy Do Whatever I Desire). Hmm – I don't like that acronym every bit much…

But the affair is, yous don't have to retire early. Maybe you dearest your job. Or, maybe you want to become to this point in life and so practise a different job that is more than fulfilling, or fifty-fifty start your ain business!

This all starts with financial liberty, then the key to achieving this as early as you can is that information technology simply just opens more doors for yous to determine later what you lot desire.

And then, allow's go dorsum to that case where you desire to retire at age 55. Y'all basically have three options:

- Go a better annual return

- Get higher raises

- Increase contributions, either if your employer does or if you exercise

You have the ability to exercise all of these, although the first two are indirect (if y'all can outperform the marketplace with your investments or if you're a boss at your job and become promotions) just yous're too limited to a production of the surroundings to a point.

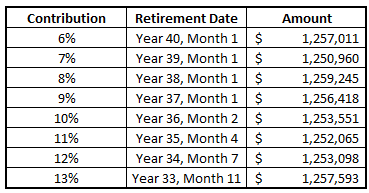

The third way is 100% on you. Even if your employer lucifer doesn't change, you can e'er put more in, up to $19,500 in 2020. So, let's do only that. I'm going to increase the contribution by i% and come across how that changes the retirement date:

I know that it might seem daunting for you to contribute xiii% of your salary to retirement, simply if yous tin can outset doing this from day ane then you're never going to know the difference.

If you showtime from the kickoff, the difference of 6% and 13% on a $36K bacon is simply about $96/paycheck assuming yous're paid biweekly. And that'southward pre-tax! If you were to actually receive that money, it would probably be closer to $seventy.

The question is this – would you rather have that extra $seventy every 2 weeks or take the ability to retire seven years early on? There is no generic right or incorrect answer – it's 100% what is best for you, and that is why it's chosen personal finance!

I urge you lot to download the 403b calculator, play around with it a little bit, and run into if you're on track for your goals. If y'all have any questions, delight don't hesitate to reach out to me at andy@einvestingforbeginners.com, and if you know of someone else that might benefit from this commodity, share it with them, or ship them the link to my 401k calculator!

Nosotros're all in this together – skilful luck in your journeying!

Source: https://einvestingforbeginners.com/403b-calculator-ashul/

Posted by: crosssurprood.blogspot.com

0 Response to "How Much Can You Put In A 403b Per Year"

Post a Comment